Federal investigators found last December that Higher One, the student refund vendor that Tufts partners with, had improperly collected 30 million dollars in fees from students across the United States over the course of around a year and a half. Following the investigation, the Federal Reserve ordered the company to repay 24 million dollars to the students from whom it benefitted and to make all information regarding its fraudulent practices available on Dec. 23, 2015.

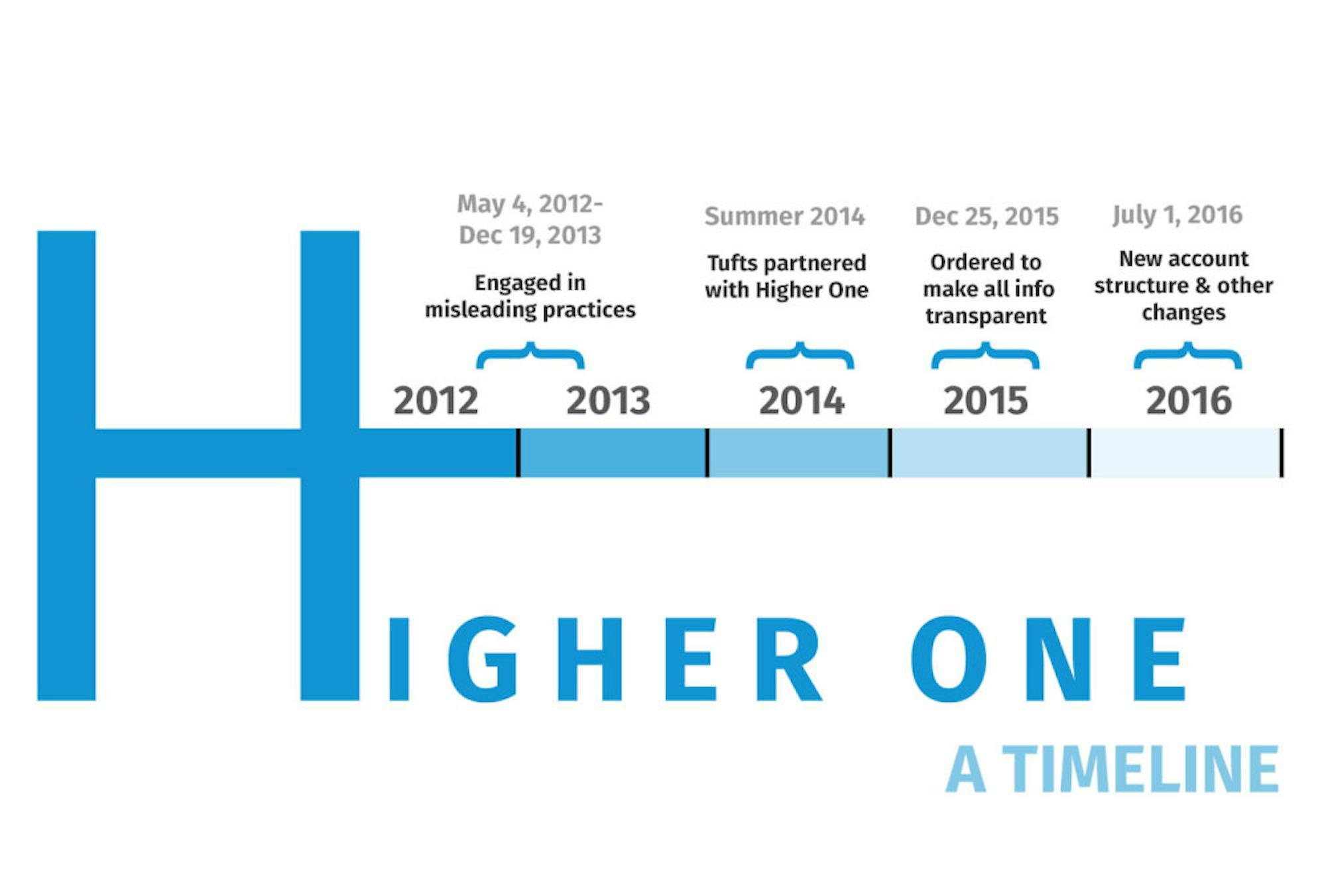

According to the Cease and Desist orderissued by the Federal Reserve, Higher One had engaged in misleading marketing and omission of important information in the period between May 4, 2012 and Dec. 19, 2013.

University Controller James Walsh explained that Tufts began its partnership with Higher One in the summer of 2014, after the company had ended their deceptive practices, and “as a result, Tufts students were not subjected to those practices.”

Walsh said that moving forward, university eRefunds will no longer be managed by Higher One, since it will be acquired by the bank holding company Customers Bancorp. This acquisition is believed to become effective by July 1, according to a Dec. 15, 2015 Customers Bank press release.

Higher One Communications Director Shoba Lemoine confirmed that Tufts had not begun its partnership with Higher One until the company's deceptive practices had ended.

"[Tufts students'] experience would likely be different than what the regulators reviewed in years past,” Lemoine told the Daily in an email. "2016 will bring some great changes to the student experience as well. A new account structure will be launched by July 1, 2016, which will include nationwide, free ATM access and no 50 cent PIN fee for certain transactions, among other great benefits."

JuniorGauri Seth said that in her experience, while Higher One has been generally cooperative, the company's website and refund policies are often confusing.

Seth said she believes that if the university continues to work with Higher One, the Tufts administration should provide better instructions on how to use the system in order to minimize chances of students paying to receive a refund.

While the Federal Reserve is requiring that students be reimbursed for fees, Seth expressed concern over the language the company currently uses in handling student refunds.

"It's fairly complicated to figure out how to get your refund without opening a Higher One account," she told the Daily in an email. "From my understanding there are fees associated with the Higher One account, so it's important to be able to get a refund without opening one of their accounts.”

Senior Melissa Hwang said that in her experience, Higher One's website and services are not very intuitive.

"It's not a very user-friendly and every time you go into it, it's always advertising [that] you should open a Higher One account," Hwang said.

According to a Jan. 2 article in the Miami Herald, several students at Miami Dade College used debit cards provided by Higher One, and were subjected to a 50 cent transaction fee each time they withdrew money without their knowledge. Now, the new order issued by the Federal Reserve will allow these students to be reimbursed fully. According to the Miami Herald, Higher One has provided reimbursements to students at up to eight different universities in Florida.

Lemoine said that in order to avoid paying the 50 cent transaction fee, students could simply choose to use the “credit” option when withdrawing money with Higher One. However, the majority of those using Higher One's services are college-age students, who may have minimal experience with banking.

According to the Miami Herald article, this is not the first time Higher One has been involved in a major lawsuit. In 2014, students at a Florida school filed a class action lawsuit alleging that the company charged unusual bank fees, violating federal regulations that financial aid money be accessible and free from fees. Higher One ultimately agreed to pay $15 million to settle the class-action lawsuit.

Two years prior, Higher One settled with the Federal Deposit Insurance Corporation (FDIC) for $11 million after it found Higher One complicit in “charging student account holders multiple non-sufficient fund [NSF] fees from a single merchant transaction; allowing these accounts to remain in overdrawn status over long periods of time, thus allowing NSF fees to continue accruing and collecting the fees from subsequent deposits to the students’ accounts, typically funds for tuition and other college expenses," according to an FDIC press release.

Hwang said that there was a lack of transparency surrounding both Tufts' initial transition from its previous financial services vendor Sallie Mae and Higher One's deceptive history.

"It's very unsettling that the administration has never released this sort of information to us," she said. "Tufts should be protecting students, not putting them...potentially in harm's way. The reason that I never questioned [Higher One] was because it was system chosen by Tufts, so I trust it or did [trust it], but now I can't help but question it."

According to Walsh, Tufts will continue with routine evaluations of the services provided by Higher One, and the university is “open to further feedback from other students on their experience with any of our service providers."

He said that moving forward, the university will continue to prioritize students in determining its financial services and practices.

“With respect to Higher One, our assessment prioritizes service to our students and has included consideration of other service providers and the development of in-house service capacity,” Walsh said.

Tufts' financial aid refund partner collected $30 million through deceptive practices

Petrina Chan / The Tufts Daily