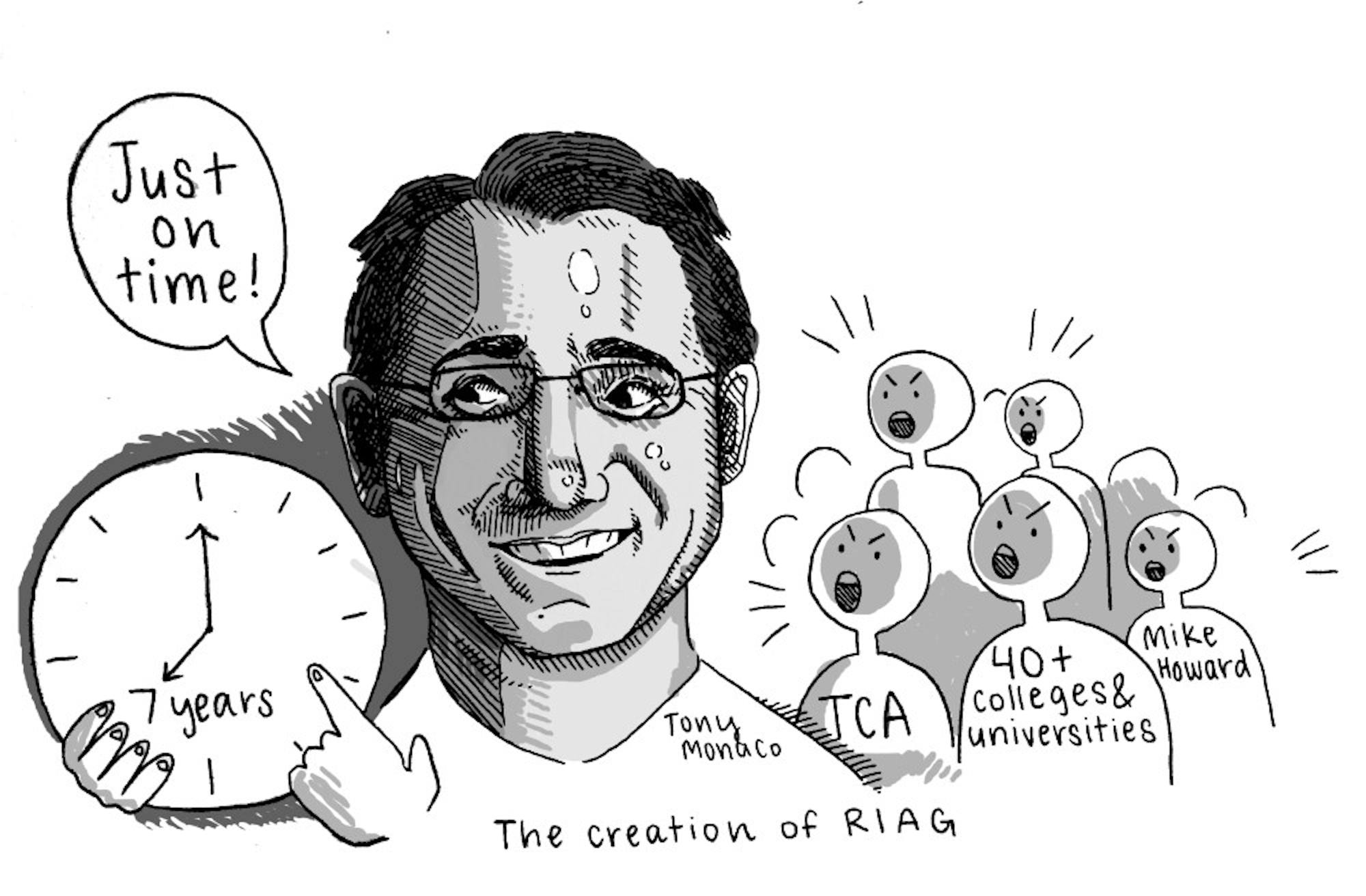

For the past seven years, Tufts student groups, such as Tufts Climate Action (TCA), have ceaselessly advocated for the university to address the climate crisis through the divestment of fossil fuels, which means liquidating all investments in the fossil fuel industry. Their adamant efforts include weekly protests in front of Ballou Hall, collecting pledges from parents, alumni and students in support of divestment, and most recently submitting a formal proposal to Executive Vice President Michael Howard. This TCA proposal calls for the divestment of all university holdings in the fossil fuel industry, describing the importance of this action in combating the climate emergency. However, this advocacy spans beyond the current student population. In 2013 the Daily published a 17 person alumni-written op-ed calling for student support of a divestment referendum, and 322 alumni signed a pledge in 2015 to withhold donations to the Tufts endowment until Tufts divests from the top 200 fossil fuel companies.

Finally, the university responded to these voices with a substantial plan. Last week, the Daily reported on Tufts’ decision to convene an investment advisory committee, known as the Responsible Investment Advisory Group (RIAG), that will advise the Board of Trustees’ Investment Committee based on their findings about Tufts’ fossil fuel investments. By finally moving on this issue, Tufts demonstrates the importance of listening to student voices about the environmental impact of its choices. This is a step in the right direction, but as Tufts moves forward with this advisory committee it is vital that it remains comprehensive, transparent and timely with its review of this pressing matter.

Given the current committee’s makeup, it has the potential to provide a one-sided review of this complex matter; the group must be adjusted in order to ensure a truly holistic review of Tufts’ investments. The committee is expected to consist of three trustees appointed by the Board, Tufts’ chief investment officer, the vice president of finance or his representatives, two students and two faculty members. As representatives of the university, the trustees, chief investment officer and finance representative likely will provide a fiscally conservative recommendation in favor of keeping fossil fuel investments, especially given the university’s track record of denying calls for divestment on financial grounds. While the students and faculty members likely will remain more unbiased in their review, the provost — another university official — will appoint these individuals, which could lead to similar perspectives as the other committee members. Thus, the university must take into account community input about appointed students and faculty members, either before or after the group’s announcement depending on time constraints. Additionally, the committee lacks a scientific perspective, another aspect of a comprehensive review. As this is both an issue of science and finance, an environmental economist should also consult on the committee in order to balance other committee viewpoints and provide insight into the expected repercussive effects of climate change on Tufts’ financial assets.

In order to fully understand the feasibility and successful method of divestment, Tufts should observe its peer universities who have already divested and demonstrated their commitment to environmental protection. Unity College, the first U.S. college to divest, has a proven track record of successful divestment that resulted in fossil-free investments at no cost to its endowment. Similarly, the University of California (UC) system reports divestment success after succumbing to student demand for a fossil-free portfolio. The decision resulted in the divestment of its $13.4 billion endowment and an $80 billion pension fund, partially due to the financial risk of remaining invested in fossil fuels, according to UC officials. Thus, this success highlights the practicality and fiscal responsibility of this action: Tufts need not reinvent the wheel but rather can use the past successes of other universities in its divestment review.

Throughout this review and recommendation process, Tufts must sustain values of transparency in order to ensure accountability and accuracy in its decisions. During the review process, the committee should provide updates about the group’s work and must commit to following the expected timeline, thus establishing a sense of accountability in ensuring timely progress on this urgent review. Additionally, as done with the Stern report, all recommendations provided by this committee must remain extensively fact-based in order to provide credibility and clarity. As the process comes to a close, the Board of Trustees’ Investment Committee must continue this trend by giving our campus an in-depth explanation of its final decision. In this form, the university keeps the original reason for this review in mind: to respond to tireless student activism calling for divestment.

Ultimately, the review committee is a great step, but without effort to retain values of transparency, accuracy and holistic decision-making, it remains just that — one step. Tufts must follow through on its positive intentions by addressing these potential issues with the review process and keep the divestment effort what it was from the start — a community-based movement to address the urgency of climate change. It is simply a matter of thoroughness and commitment.

Editorial: As the divestment review process begins, Tufts must stay true to the movement's values